|

First let us state clearly, "Peak Oil" is not some petroleum-rich mountaintop in Saudi Arabia!

Ah, yes, we kid. But the ramifications of the world hitting Peak Oil are no joke. A permanent reduction in the availability of petroleum will change the world as we know it, and without proper foresight, preparation, and transition strategies, the change will not only be unwelcome, it will be chaotic and catastrophic.

|

Because we know how much Grinning Planet readers like to be in-the-know (at least enough to be a hit at cocktail parties), we have assembled a Peak Oil FAQ—answers to the most frequently asked questions about Peak Oil and related issues. Enjoy (and act!) ...

|

| |

PEAK OIL ...

FREQUENTLY ASKED QUESTIONS

(page index) |

|

|

|

There are a number of competing definitions for Peak Oil, but here is the one we think is most practical:

Peak Oil is the historical point at which the annual volume of oil production is the highest it has ever been or ever will be.

Once we pass the peak, global oil production begins to decline, continuing a downward trend until finally, decades later, the oil that remains in the ground is unrecoverable at any price because it takes more energy to pump the oil than the one gets from its use.

|

So, technically, Peak Oil is just the point of maximum global oil output; but more broadly, it has enormous economic implications because the globalized economy—and all of our lives—have been built on a foundation of cheap oil.

An important corollary to the "maximum production" definition is:

Once we hit the peak, the demand for oil will always be greater than the supply.

This will cause prices to skyrocket, which in turn will cause economies to nosedive. We are entering this period now.

|

|

PEAKING VS. RUNNING OUT |

|

One common misconception is that reaching Peak Oil means we're about to "run out of oil." That's not the case—it's only the halfway point. At peak, there is still just as much oil left in the ground as we have already produced. But we've already pumped the "easy oil," and the oil that remains will cost much more to extract and refine.

We will actually never be "out of oil"— we will just be out of oil that makes economic and energetic sense to recover. What is fair to say at this point is that we are out of surplus oil—that is, there is no longer a production buffer keeping the supply curve comfortably above the demand curve, and that is the most important factor in spiking oil prices.

|

|

The ride up the petroleum production curve was exhilarating—it allowed for expanding economies and higher levels of prosperity for many, as well as greatly increased population levels. The ride down the oil curve is likely to be much less fun.

Consider the following:

- Oil accounts for 95% of global energy used for transportation.

- The food we buy at the grocery store is highly dependent on fossil fuels—modern agriculture uses roughly 10 calories of fossil energy to produce 1 calorie of food energy. In the US, the average supermarket item travels 1,500 miles to reach your shelf. In Canada, the distance is significantly higher.

- Non-food goods usually come from even further away, shipped or flown to the US from Asia.

- We rely on hundreds of petroleum-based products in our daily lives, including plastics, clothing, disposable diapers, medicines, appliances, shoes, toys, computers, cars, and building materials.

- Housing purchases, job choices, vehicle selection, and many other facets of daily living have been predicated on the continued availability and cheapness of oil and its derivatives. Similarly, the basic building blocks of society—highways, bridges, buildings, and geographical distances between things—were designed based on the assumption that petroleum and other energy sources would continue to be cheap and abundant.

We're already seeing spiking oil, gasoline, and diesel prices, and we will likely see even higher price levels in the future. What if gasoline gets to $7 or $9 a gallon—or more? What would you do if the 5-hour gas lines and dry pumps of the 1970s came back—and never went away again? What would that do to the economy—and what effect would that have on your job?

Unfortunately, the scenarios get darker from there. Most of us are extremely dependent on remotely supplied goods and services, all of which depend on oil availability to some extent. Thus, our lives are very vulnerable to problems with oil supplies. Fuel disruptions may wreak havoc on the global economy's just-in-time supply chains, ultimately causing a breakdown in availability of critical items. What would you do if food in your supermarket started being available inconsistently? What if there were a water main break in your neighborhood but the water company's trucks were all temporarily out of fuel and couldn't get there to repair the line?

|

At a minimum, ever-increasing fuel prices will lead to increased prices in other goods and services, most of which include petroleum among their input costs. At the same time consumers are seeing the equity in their homes vanish, especially for houses that require long-distance commutes to get to work or stores. Low-fuel-economy vehicles are becoming unaffordable to fill up and suddenly have poor resale value, limiting any budding desire to trade in for a more fuel-efficient car. Wages are stagnating, layoffs are rising, and good jobs are become scarcer. Prices for the basics of daily living are spiraling upward steeply (in spite of the laughably low inflation numbers presented in the government's Consumer Price Index). Consumers are getting squeezed from all directions—but oil is the one theme running through all of it.

|

THE ECONOMY: DEBT AND OIL,

RISING TO THE SURFACE |

|

In the US, additional economic risk is imparted to the situation by the high levels of personal debt, federal debt, trade imbalances, and the ongoing crisis in housing and finance. Non-US entities now hold a majority stake in US federal debt and could dump their holdings or stop buying more at any time, heightening the danger. Relentless increases in oil prices and the falling US dollar will deepen the recession in the US and may cause the "debt bubble" to burst.

Forbes Magazine points out:

"At $135 per barrel, the US spends $1.0 trillion per year on oil, which is equal to 15% of the $6.8 trillion in take-home pay of everyone who pays taxes."

And that doesn't even include expenditures for electricity and natural gas. More than two decades of ignoring oil dependence and excessive energy use are now coming back to haunt us.

|

|

You may have heard people say there is lots of oil left enough to last for decades at current consumption levels. These people tend to be politicians, pundits, and economists—not trained geologists. A consensus is forming among true oil experts that petroleum production has recently peaked, or will peak within the next five years—ten at the most—with little additional production increase between now and then.

Peak Oil has serious ramifications, so it's no surprise that those with substantial interest in the keeping the status quo going as long as possible downplay the topic of Peak Oil. It's interesting to note that those who say Peak Oil is happening now or soon rarely have anything to gain from their opinions, whereas Peak Oil deniers almost always stand to lose money or power if the public wises up to the situation and begins changing behaviors.

Mainstream media organizations are starting to talk regularly about energy issues, and occasionally about Peak Oil. Unfortunately, they rarely get it right. Their stories are mostly about the price of gasoline and diesel, focusing on how gas prices are affecting people's lifestyles. Any mention of inadequate petroleum supplies being a cause of the problem always comes well after the usual suspects have been lined up—greedy oil companies, out-of-control commodities traders, uncooperative OPEC countries, gas-guzzling SUVs, a supposed lack of refinery capacity, and environmentalists who care more about preservation of pristine wilderness areas than preservation of the endangered American motorist.

But consider the following facts:

- Global oil discoveries peaked in 1964. (Yes, more than four decades ago!)

- Since 1981, the world has consumed more oil than it has discovered. Today, we consume roughly 5 barrels of oil for every 1 barrel that is discovered.

- In the last century, "giant" and "super-giant" oil fields have traditionally supplied most of the world's oil. They still do today, but output from many of these fields is now declining, and in the last decade new discoveries of such fields have ground to a halt. The world has been thoroughly explored for oil. It is extremely unlikely that we will find new super-rich oil fields to replace the aging giants.

- Many oil analysts agree that oil reserves among countries in the Middle East—which everyone agrees is the region with most of the world's remaining oil—are significantly overstated, leading to false assumptions about how much oil the world has left. Saudi Arabia, which is often pointed to as the "go-to country" for increased production when supplies get tight, has been unable to increase production in the last three years. Some analysts assert that production from Saudi Arabia itself may have already peaked.

These trends all point to a near-term peak in petroleum production. The only real questions are:

- When? ... and

- What do we do about it?

There is almost no disagreement that we will one day reach Peak Oil, but there is substantial disagreement about when. A number of analysts think the peak has already occurred, in 2005 or 2006.Others believe that the world may be able to slightly raise production over the next few years, with a final peak occurring somewhere in 2010-2011.

Today, only political Pollyannas and free-market charlatans remain in the camp that says the peak is still decades away. Politically driven estimates from organizations like the US Geological Survey and the US Energy Information Administration remain relatively rosy, downplaying any serious petro-problems. Such optimistic estimates are designed to boost market confidence and keep overall consumer sentiment high, because a fearful consumer is not a high-spending consumer. It's worth noting that the International Energy Agency, which had also previously been in the "peak is decades away" camp, has recently been revising their future-production estimates substantially downward.

A few outliers even believe that Peak Oil will never happen at all, either because higher prices will always work to create more supply even from ever-poorer energy resources, or because they think that oil is regularly replenished in the center of the earth via geologic (abiotic) processes. Neither idea holds any scientific merit. The first idea, that higher prices will always stimulate a move to other energy sources, ignores basic laws of physics. And the latter idea, that the earth continually replenishes its oil is about as believable as the exploits in The Journey to the Center of the Earth, where the adventurers find hidden worlds inside the earth, complete with artificial light, raging seas, dinosaurs, and prehistoric humanoids. Such subjects make interesting stories, but the abiotic theory of oil should not be seen as anything more than a fanciful idea—and a distraction from the seriousness of the situation and the magnitude of the challenge we face.

In the past, when individual countries reached their oil-production peaks, it was very difficult to predict the precise point of peaking in advance but it was easily recognized in retrospect. It often takes years to be sure that a oil production from a given field, region, or country has peaked. When all parties finally agree on the date that global Peak Oil occurred, it will already have passed—it will only be possible to make a positive ID in hindsight.

|

Whether we are hitting peak now or will hit it in half a decade is less important than the timeframe required for effective mitigation actions. The 2005 "Hirsch Report," a US government-sanctioned study of Peak Oil, evaluated potential impacts and solution scenarios. The report concluded that to avoid serious impacts related to a petroleum production peak, we would need to start a massive conversion of our economy's infrastructure (away from oil) one to two decades in advance of the peak. Do you see a "massive conversion" happening today? Nope.

Solution-wise, we are still tinkering at the margins and have not yet begun to implement substantial solutions. Thus, even if Peak Oil occurs in 2011 rather than now, we are already waaay too slow in starting to address the problem. Trouble is almost guaranteed at this point.

|

OIL-SUPPLY RISK —

EVEN WITHOUT PEAK OIL?

|

|

Though peaking of global oil production is a guarantee of global economic shocks, it also possible for oil to cause lots of problems well in advance of the peak if demand is greater than supply.

In the period 2006-2008, the world was producing and using about 85 million barrels per day (MBD) of petroleum. But today the oil demand curve is already above the oil production curve, which is causing oil prices to rise sharply. We're already seeing serious economic impacts from the price spikes.

Even if the world manages to put off Peak Oil for a while longer—that is, we continue making incremental gains in petroleum production levels—it is likely that demand for oil will continue to rise faster than any increases in supply, and the economic effects will only get worse from here.

|

|

People always want to believe that our presidents, senators, representatives, governors, regulators, and scientists will solve any problems that pop up, that all will remain well, and that we personally don't have to worry about knotty problems such as "where will oil come from in the future?" Oh, if it were only so.

When it comes to oil-supply problems, supposed "magic-bullet solutions" abound and are touted regularly by public officials:

- "The 'Hydrogen Economy' will produce totally clean energy from the most plentiful resource in the universe, hydrogen."

- "The oil in the Arctic National Wildlife Refuge and offshore drilling will free the US from oil imports."

- "The tar sands in Canada and the oil shale deposits in the American West have more oil than Saudi Arabia."

- "We all need to drive hybrids."

- "Biofuels will allow us to turn our farm fields into oil fields."

- "Technology will save us."

It is suggested by advocates of these approaches that they will allow us to avoid the coming energy crisis. They won't. Let's discuss why.

More Drilling

Increased drilling is often the first thing mentioned in today's discussions of US energy policy. In particular, proponents say drilling in the Arctic National Wildlife Reserve (ANWR) and in shallow waters off the US coast are solutions to America's energy woes. Don't believe it.

While the US uses 25% of the annual global production, it has only 2%-3% of global oil reserves. Those are numbers that will never be reconciled by simply increasing domestic supplies.

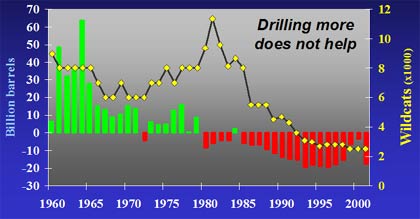

What about the argument that increasing oil prices will promote new extraction of previously uneconomical oil resources? This is right to an extent, but the effects of higher oil prices are limited by geology. In the figure below, we see that up until 1980 (the green bars) the world was discovering more new oil than it was using in production, and thereafter (the red bars) the world began using its built-up reserves to meet demand. The black line with the yellow dots plots the number of wildcat wells being drilled in search of new oil, showing that industry responded to the declining discoveries and increasing prices in the late '70s and early '80s by increasing their drilling efforts—until they figured out that the additional drilling was not producing results.

More Drilling Does Not Help

Similarly, in the late 2000s, oil crossing the lofty $100/barrel mark has not result in any significant increases in production.

Its also worth noting that the added production from the huge Prudhoe Bay field in Alaska a few decades ago made little difference in the overall downward trend of the US's oil production curve, which peaked in 1970-71. Similarly, even if we decide we're willing to ignore the environmental risks associated with drilling in ANWR, in the deep waters of the Gulf of Mexico or the fast-thawing Arctic, or along our coasts, the output from all of these "solutions" combined will not come close to solving our energy shortfall (let alone "freeing us from foreign oil").

Biofuels

Ethanol, biodiesel, and similar non-petroleum fuels all suffer from one important flaw: The energy required to produce them vs. the amount of energy made available as fuel is much lower than the "net energy" available from petroleum-derived diesel and gasoline. In the case of ethanol, some studies have even shown that it takes as much energy to produce ethanol as you get out of it as new fuel.

Further, at today's high fuel usage levels, there is insufficient crop land to implement a wholesale changeover from petroleum to biofuels. Finally, if implemented on a large scale in the US, standard biofuels production (from industrially farmed corn and soybeans) and cellulosic ethanol (from scrubby native plants and farming "waste") will succeed only in further degrading our fragile topsoil and range lands.

Non-Conventional Oil

Vast amounts of fuel are contained in tar sands and

oil shale.

Canada is heavily exploiting the former, but will face limitations from fresh water availability, environmental impact, and high refinement costs and energy requirements. Like biofuels, oil shale returns little more energy than is used to mine and refine it. Saying that "Canada is the Saudi Arabia of tar sands" or "the US is the Saudi Arabia of oil shale" is comparing rotten apples to oranges.

Coal-to-Liquid and Natural Gas Liquids

The process for converting coal to liquid fuels is a well established technology, but it generates twice the carbon dioxide per gallon of fuel that conventional oil does and has lower net energy than petroleum. And let's not forget that coal mining is one of the most polluting, destructive industries there is. Converting natural gas to liquid fuels is even more foolish—natural gas is one of our cleanest-burning fuels, and doing anything other than burning it directly for use in vehicles, homes, and power plants is like turning gold into lead.

For the purposes of this Peak Oil FAQ, we have addressed only a few of the most commonly proposed "non-solutions." A more thorough analysis of why most of the oft-mentioned alternatives won't work is available in this Grinning Planet article:

Peak Oil and Environment.

Yes, but there are no silver bullets, no quick fixes, no painless solutions. Initiative, effort, and persistence will be required.

The three most important solution categories are:

- Efficient Automotive Fleet — Plug-in hybrids, combined with more electricity generation from wind, solar, wave, and tide power, will likely prove to be the only workable long-term solution for the personal auto fleet. But we are proceeding far too slowly on these fronts—technological advancements (like better batteries) still lag, and we are still putting the majority of our government and industry dollars into dinosaur energy and transportation technologies (like oil, coal, and nuclear).

- Efficient Cargo Fleet — We must reestablish and reinvigorate our rail and river-based transportation systems. The sun is setting on the day of the 18-wheeler. But again, these are not among the business-as-usual solutions being discussed in Washington.

- Relocalization — The first two solutions are our best bets for addressing the coming transportation disaster. But in the long run, even they will struggle against the tide of decreasing energy availability. Importation of basic goods from overseas will be very limited in the future, and tomorrow's leisurely drives to the outlet mall or elsewhere will be as infrequent as today's vacations. We must relocalize our lives and our economies. Commutes must become shorter. Local production must be reestablished—for all goods, but particularly for food.

There are many energy technologies that will contribute to our energy future, more or less, but none will be able to replace oil. Not even all of them in combination will be able to replace oil. (For additional analysis, see this Grinning Planet article:

Peak Oil and Energy Solutions.

What we face is a complete reengineering of our economy and our lives, sliding back down the energy ladder to adjust to decreasing oil supplies and, eventually, decreasing total energy supplies. That sounds scary, but ask yourself: Do you think things are heading in the right direction today? Will 10 or 20 more years of "progress" along the lines of the last 50 years really make us better off?

Like most people, you probably think there's lots that should be done differently in our locales, in our country, and in the world. Given that cheap, abundant energy has not helped us avoid today's mess of a civilization, it seems silly to assume that maintaining (or even increasing) energy flows would foster the needed change of direction.

That is not to say that there isn't danger ahead. Increasing energy prices are part of a brewing economic tsunami, and sudden disruptions of energy have the potential to interrupt food supplies and other essential services.

But it's not hopeless—preparation for the coming energy crisis is possible. People and communities can develop small-scale local strategies. The critical thing is to "relocalize" to rebuild societies based on the local production of food, goods, and energy. The more localized a community is, the more resilient it will be in the face of the effects of Peak Oil and related disruptions.

Just as important, the likely turbulence of the next few years should be seen as an opportunity to achieve true change for the better. It's time to stop believing in the faux change always promised but never delivered to us by our poltroonish politicians, which infest both major parties.

|

So, while Peak Oil is a flashing red warning sign, it can also be seen as an opportunity to reevaluate what is really important to us, to strip away the artificial fašade of "the good life" as it is preached to us by Hollywood, Madison Avenue, Wall Street, and Washington, and get back to the business of knowing how to do things for ourselves and working with our neighbors to make our communities stronger and less reliant on distant governments and corporations.

|

|

This is the point where we normally say something like "Know someone who should read this Peak Oil FAQ? Please forward ..." But in this case, the topic is so important that EVERYONE you know should read it! Please send it to them.

Books, other articles, and resources:

Sign up for our free email list so you don't miss anything! Options:

Get Grinning Planet free via email

|